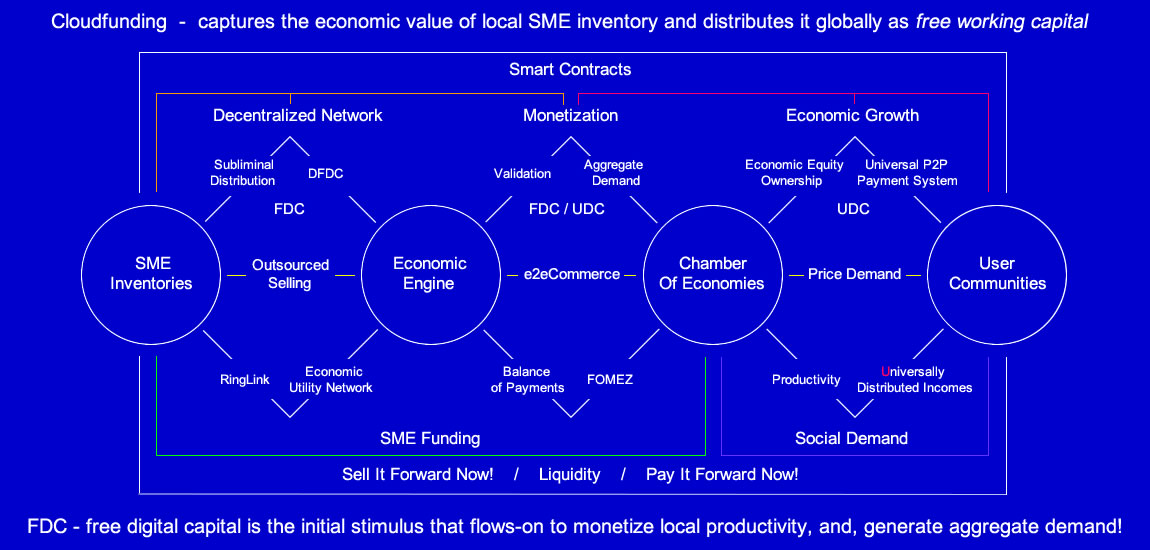

DeCom Markets FOMEZ GPEUN Queen Bee DOMIndex Economic Engine FEV Smart Contracts UDC DFDC UDI PriceDemand Cloudfunding Main St

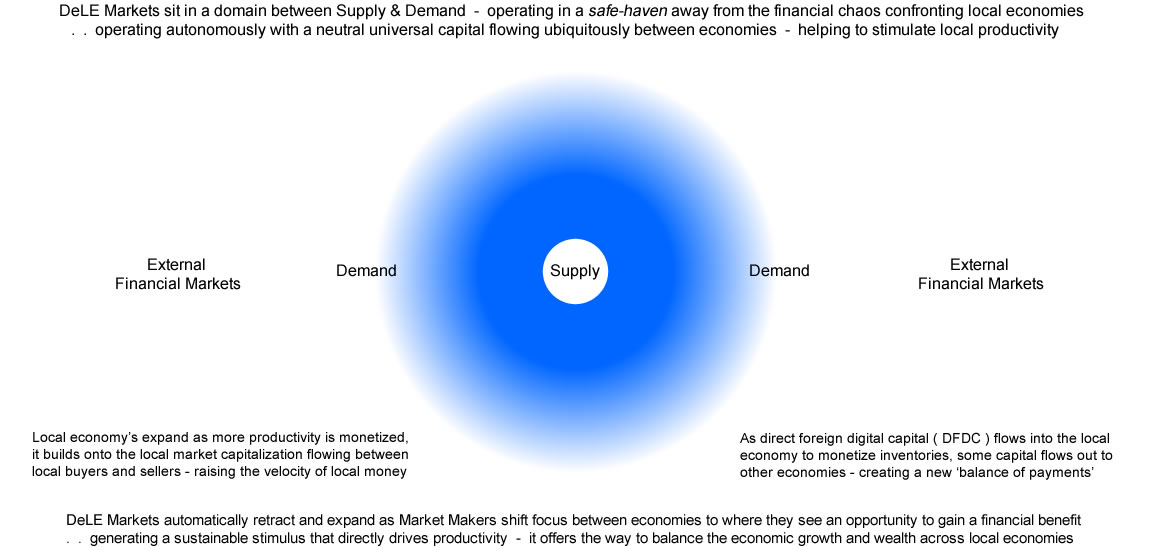

Using the economic value of local economies, instead of credit, or money, whichever way you want to term it, it offers a different scenario of how economies can be driven to achieve greater volumes of productivity without creating debt - the Decentralized Local Economic Markets fit between the seller's supply side and the buyer's demand side - without needing an external value or a central controller dictating who can borrow and use their product ( credit / money ), which can stifle productivity because the debt in which borrowers commit to, is subject to forces out of their control like a downturn in the economy and changes in the interest rates.

Technology can bypass the analogue management tools that central authorities still try to use to control the global interaction of economies using credit and debt - technology that uses a decentralized mechanism and real time data are able to be more responsive in the digital economy than the old economy's thinking that a little interest rate adjustment here and there will be able to affect changes - sure it may change the financial markets but it has little or no affect on productivity down in the real grassroots economy - this is where changing the mechanics of capital flows to flow between the supply side to the demand side, with incentives to stimulate the productive activity within an infinite loop that can move across borders and industries in a seamless flow, makes SMEs and all size Main Street businesses 'the new local banks'.

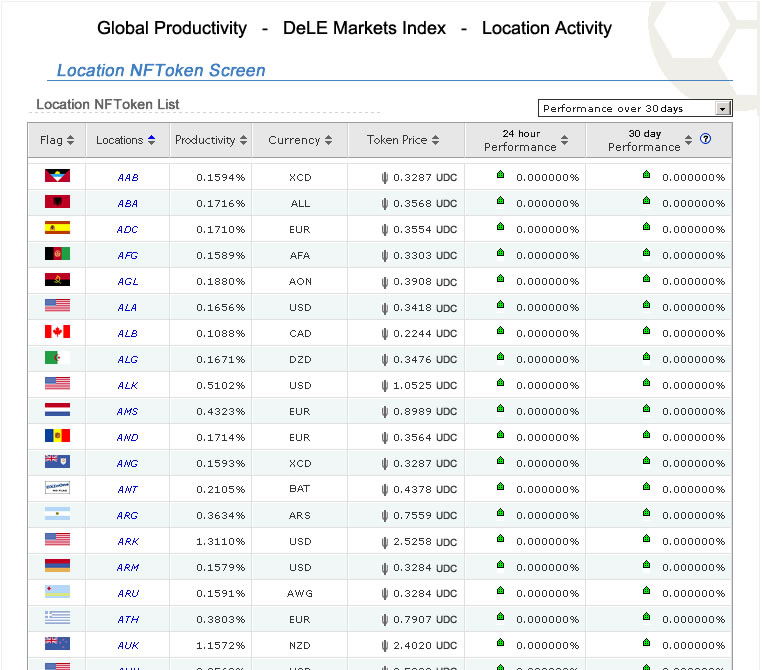

Global users directly fund local SMEs when they 'collect' local economy tokens

Users have UDI portfolios in which they can collect any number of units in locations around the world, and in doing so directly fund industries and businesses located in those local economies - this funding is free for businesses to invest back into their business to generate supply, and incentivize global users to back the local economies by being proactive as an OMM, while users benefit from the distributed gains from productivity in local economies in their UDI portfolios.

DeCom Markets use technology that tracks the economic value in productivity in local economies down to 14 decimal points, as it's interacted with across the world in real time, without using credit and debt as an instrument of control - instead technology can now capture the aggregate demand of global productivity, and drive it back into local economies through a recycling mechanism that validates the huge stockpile of inventory - initially distributed subliminally as free working capital, without creating debt, it taps into an existing resource sitting and waiting to be activated into sales - giving sellers full selling prices paid in real time, without using credit terms ( helping to restock and expand productivity ), and buyers have low affordable prices that they want to pay, all on a global scale.

Retractable market dynamics create a new dimension

But as more market makers direct their focus on specific location by helping to drive productivity and collecting more units, there's a change in the dynamics with a lower share available of the economic equity - this specific dynamic adds another layer of strategy for market makers to decide whether to increase their direct involvement in generating more productivity ( if there is any to monetize ), or shift their focus on to other economies - this is when some market makers will liquidate the number of location units and move to other locations ( basically expanding one market and contracting another ), the result means that as units are liquidated they are dissolved, leaving the remaining market makers gain a greater share available of the economic equity, which they can continue to benefit from as they help drive productivity - this is a change in the way the traditional Balance of Payments are handled with economies by the financial markets and systems at the national level, it brings it down to a decentralized local level that can directly balance the flow of trade and payments in real time.

It's a new market, and a paradigm shift in how capital flows between buyers and sellers

The economic infrastructure behind the economic markets is a revolutionary change to empowering a resource that has been left untapped - it's an unlimited resource that has an economic value representing the true commercial value of local economies - and it's been largely ignored by the financial system because of the inability of liquidating its true value into capital - what the economic markets have is technology that captures the full retail selling price potential of the local inventories for the sellers, and releases it to consumers with the ability for buying prices to cascade down to 20% of the full selling prices, without it affecting the seller's full prices - the economic markets have the ability of tracking new capital flows that operate specifically between the supply side and the demand side, from the time when inventory is ready to be sold, to when those products and services are purchased and exchanged with buyers ( without holding or transferring any local currencies across borders ) - all done by using an economic value that's governed constantly by products and services linked to a Global Price Index - it's totally different to the financial systems approach of creating money out of thin air ( like credit and bonds ), so it can be thrown into financial markets, without any consideration of tying it to any real productive value.

The economic value has an entrenched position in the mechanics between supply and demand, making it uniquely autonomous for it to facilitate trade between buyers and sellers without an external product ( like money provided by the financial system, even cryptocurrencies ), which means that there are no third party incumbents such as payment providers or currency exchanges required, therefore avoiding speculation, interest, fees or spreads - this allows the entire economic value to be used as a stimulus to generate productivity in the local economies by way of a balance of payments that provides a democratic and vibrate way to monetize inventory - this is an important factor when SMEs in the real economy can outsource the selling of their inventory at full selling prices in a matter of days, sometimes in hours, to monetize and get cashflow liquidity with sales, compared to weeks and even months to get credit or loans ( if possible ) that locks in collateral like houses - the volume of local seller inventory value is far greater than the volume of credit and loans that could ever be created and approved.

Decentralized Commerce Markets move to the pace of productivity in real time

It's no longer about money created from nothing but about economic value tied to productivity

The economic markets differ to the financial ( share ) markets by having the architecture that only works with a linear growth and increases only when there's productivity in a location ( local economy ) - it may even have zero growth due to no productivity but it can never be negative ( in contrast to share market crashes ) - the open market design allows the market makers to fluently move strategies between the local economies as they see an opportunity of gaining a bigger share of the productivity's LAT ( location activity tax ) that's distributed in real time to users holding the various locations, which can build out to thousands of local economies around the world - it positions global users as economic equity owners of local economies, giving those users holding ownership a reason to ensure that productivity is continually generated ( by market makers ) - each global users has a universally distributed income portfolio to operate with as a defense for inflation ( it's been referred to in recent times as a universal basic income ) - instead of the gained wealth and income coming from a local tax on a single country's society, it's drawn from the real collective productivity across thousands of grassroots local economies from around the world.

Decentralized economic markets are designed to be pro-active

While the financial markets are structured around the share market as the leading indicator of company efficiency and profitability, it relies wholly on investors channeling money into buying shares in companies in return for dividends as well as share prices that rise - the skill of company strategists, analysts and traders has been refined over the time ( since the East Indian Company was formed ), to convince people to hand over money so the companies can expand and be more productive - that formula and ideology has changed over time and skewed the distribution balance to favor those doing the steering and sharing the spoils.

The economic markets have always been around but never modeled, until now, to represent the productivity of local economies, all the way down to the towns, cities, regions and countries - while every economy is different in size, they can all be treated equally in the new economic markets platform by using an open market democratic formula that allows local markets to expand the number of location units available as market makers see the opportunity to help drive productivity in the specific locations through industries and businesses - it's where the market makers use direct strategies to gain the benefit by getting a greater share of the local economic equity that they help to generate in the grassroots supply chains in the real local economies.

Benefit from productivity flows into Universally Distributed Incomes

The economic markets operate in real time, which means as market makers drive the local productivity via monetizing the seller's inventory, then waiting for local buyers to use price demand and the cascading buying prices, triggering the release of the seller's full selling prices and the LAT ( location activity tax ) to complete the real time process, which then distributes the increase in the location unit's value to the holders as universally distributed income - this direct involvement of market makers being pro-active in making individual strategies to generate productivity in economic markets in real time, differs greatly to how financial markets operate.

Local economies can avoid bottlenecks in the supply chain

With the volume of economic value sitting in inventories being greater than the volume of loans and credit that the financial system can release across local communities, there's more reason to have decentralized but independent accountable economic infrastructure that can handle new capital flows in real time between the demand side and the supply side, and avoid bottlenecks between markets.

Decentralized Commerce Markets - are designed to scale productivity

While the financial markets are built around using money as the central product and value, which's loaned out to borrowers, who pay interest during the time of its use, its basic aim is supposed to be productive by helping to build economic wealth for its borrowers, and provide profit to the lenders.

Although money is created out of thin air just for the purpose of lending, there's still a risk that there's no productive outcome from its use, or there's a failure to repay, so lenders have basically preferred to gain by speculating on asset prices where they can artificially control prices, instead of generating productivity.

The economic markets of the decentralized local economic markets are differently structured to specifically be productive using an economic value tapped from local inventories that has a true intrinsic value - constantly tied and governed by the volume of productivity ( in products and services sales ) being produced across all local economies.

Productivity is the main mechanism by which local economies gain economic wealth through the trading of products and services from the supply side to the demand side of markets - which's where DeCom Marketss disrupt the status quo by shifting productivity from being the last ( hopeful ) step of the financial system's labyrinth of rentier services, to the leading catalyst, that directly drives economic wealth and growth into local economies through debt free stimulus that can be sustained as long as there's supply looking for demand through outsourced selling of inventories at full selling prices, and cascading buying prices that give buyers affordability and greater buying power

The economic value of inventories in local economies is a resource with an intrinsic value that's trackable on a global scale - it's unique in that it can't be manipulated in value ( as in increasing asset prices ), and can be distributed as free working capital across the real local economies around the world - where with deep tracking technology, can capture the aggregate demand of global productivity, and through a recycling mechanism, validate the free working capital into a neutral universally decentralised capital - that can then be liquidated into any global currency at local businesses in typical daily sales, without interest or costs.

A good example of how a big ticket item can come close to the reinvention of the assembly line and the increased productivity of the early 1900s, is with Electric Vehicles of today, that so far have had limited success in sales - with the economic infrastructure that DeCom Marketss operate by outsourcing the selling of the inventories at full selling prices and price demand with cascading buying prices, it can place the Electric Vehicle industry in the fast lane in scaling productivity in the 21st Century - with fully monetized inventories for sellers prior to releasing the EVs to the local buyers, it guarantees sales even before buyers have the chance to pay prices they want to pay.

Economic value is the true value of the real economy

Tapping each local economy's economic value by applying subliminal organic advertising, before validating it as a means of exchange, is a profound difference to the financial system's creation of money to facilitate commerce - in the real economies the economic value is the new economy's foundational value that can't be destroyed or diluted, whereas money created for credit is destroyed when it's repaid to balance the lender's books, which effectively dilutes the local economies of economic wealth when the payments and additional interest payments are taken out of the local cashflows ( money supply ) using real money gained from real productivity ( wages etc ).

In the economic markets ( DeCom Marketss ), as the economic value is validated from the free economic value ( free working capital ) into the neutral universally distributed capital ( by recycling the global aggregate demand of productivity / actual sales ) - it means its value can't be diluted or changed, even when it gets transferred across the world ( without costs ) - it has one important attribute, which is, from its origin, it can be tracked from peer to peer down to 14 decimal points in real time, for security.

The supply of universally distributed capital held by global users increases organically as more productivity is validated in local economies, and its value remains stable by using the aggregate value of global currencies, which allows it to maintain its neutral position as it integrates across supply and demand in the local economies - the benefit of being uniquely stable against all global currencies, allows asset prices to maintain stability ( without needing to use inflation ), while local currencies fight to hold value against other currencies.

Main Street now has a sustainable cashflow model

Main Street is the traditional center of local Commerce - and now Cloudfunding is delivering a new era in selling for Main Street!

Local Main Street sellers now have the competitive advantage from technology to finally get the benefits of what the Internet promised.

Local Economic Distribution - LED Hubs are an on-the-ground outlet that uses the dynamics of Cloudfunding to give local sellers and buyers the ultimate in competitive pricing, with the convenience of free local pickup and delivery 24/7 - LED Hubs are designed to increase the velocity of Commerce between local sellers and buyers, and so raise the local economic outlook for everyone.

What LED Hubs do is provide Cloudfunding economics for local Commerce to have a direct action point for increasing productivity output in a city, state or country without relying on authorities from above - the trickle down approach in economics has been little more than a 'wait and see, it'll come' waiting for wages to rise - local economies need new strategies where interaction with other local economies can feed off each other to build out a sustainable long-tail economy to economy ecosystem - e2eCommerce.

LED Hubs sit between local sellers that may be located in the central business zones and buyers who live in outer suburbs and only occasionally shop in the central city or shopping precincts - the inventory held by sellers within zones has sufficient economic value to exponentially drive an entire local economy on a sustainable path to growth that leads to economic flows over into other local regions.

Free Open Market Economic Zones - FOMEZs automatically form as local sellers and buyers trade together, with both taking advantage of the competitive advantage that sellers have competing for market share - that advantage comes about with a shift in the economic infrastructure model at the local level, one that fully monetizes a seller's products and services before being released to local buyers - it's done by integrating a collected value ( activity tax ) from previous global productivity, which's able to exponentially and sustainably monetize an infinite loop for any amount of inventory listed by sellers.

Exponential, predictable and sustainable sales

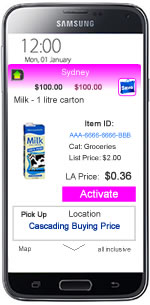

Cloudfunding gives local sellers the environment where they can sell inventory in greater volumes at predictable full selling prices at a faster turn-around rate than traditional selling - and local buyers have more incentive to buy with Price Demand that allows buyers to pay prices they want to pay - for Sellers of pizzas to fashion to cars, the sales volume can exponentially increase and be sustained with real time reconciliation which avoids needing credit terms - Cloudfunding integrates a free peer to peer exchange of local fiat currencies with a neutral internationally tracked trading unit of account to securely exchange the Ownership of products and services in real time, without holding or transferring any local currencies across borders - Cloudfunding breaks down the financial inclusion barriers by decentralizing control over Capital flows across economies using a global consensus.

Cloudfunding gives the overall community the means of being proactive within their own local economy, and get a direct benefit without the waiting - instead of shareholders benefiting via dividends from a company's profits before employees, Cloudfunding breaks down the hierarchy in the economic model and gives the individual user the means of gaining financially from the various number of local companies selling products and services within an economy via Outsourced Selling, Price Demand and UDI portfolios.

The economic model behind local Automated Selling

Think of all the idle inventory sitting on shelves in retail stores and in storage warehouses waiting to be sold or the components and ingredients for a restaurant meal or a pizza ready to be made on demand - these are the huge volumes of local inventories of products and services ready to be monetized with Outsourced Selling and sold with Price Demand within minutes or hours rather than days or weeks - monetizing can be as broad as selling a tooth brush to selling a used car or even a house, each can be quantified and has a full selling price - what's so unique about Cloudfunding is the predictability in sales without Online or Offline marketing and the advantages gained by sellers and buyers - Automated Selling.

Inventory sales can be stocked up ready to release to buyers whenever sellers want sales to be completed - unlike traditional flat line selling that uses costly advertising, which is usually combining discounts in the hope of getting sales, Cloudfunding uses Outsourced Selling to first sell to the global network of market makers to fully monetize the selling prices - all that happens before the seller releases the deals via the platform into their trading zone where buyers use Price Demand to compete to buy at prices they want to pay.

Sellers can also compete with one another across all types of industries for Generic Deals that can be purchased in bulk for such things as restaurant meals, pizzas, milk even hotel accommodation or fuel - these deals that can be customized to suit any industry have already been processed and monetized and are ready to buy using Price Demand at the prices buyers ( sellers ) want to pay - the difference is that when these bulk Generic Deals are separately released to the seller's local buyers and sold via Price Demand the full selling price, and the amount paid to buy the Generic Deals, are released into the seller's Business account - Generic Deals are processed in advance to maintain an equilibrium between sufficient supply for the more predictable demand across the economies.

Distribution of monetized local inventories

Cloudfunding captures the financial gain from an economy's productivity and distributes that gain through to the individual users without the risks associated with holding equity in companies with the speculative Capital Investment in share markets - Cloudfunding gives users the opening to be part owner of local economies with a direct impact on local productivity, while operating in an insulated environment away from market speculation and volatility.

In todays modern economies there's more spin than truth when it comes to how well the economy is going - all the data used and commented on is mostly at the national level with results of GDP and surpluses and deficits, not at the grassroots of economies where the average person makes a living - Cloudfunding opens a new frontier to challenge the status quo by focusing on Localization.

Cloudfunding takes over the role left open by the banking industry after they moved away from serving consumers to fully focusing on shareholders and profits - abandoning the mandate they were originally formed to do, for the social good - Cloudfunding fills that vacuum, not by digitizing old legacy systems but by disrupting the whole Commerce landscape to form a new ComTechX industry that digitizes traditional cash commerce and keeps local currencies circulating in local economies - this allows sellers ( SMEs ) to be a major influence in the flow of local currencies moving in the local economies between buyers and sellers exchanging products and services, eliminating any need for third party marketplaces or payment service incumbents.

Living within our means - advantage of price discovery in free open markets

Localization has always meant that things centered around local productivity between local buyers and sellers - but the world economy has changed with the internet connectivity - what Cloudfunding does by focusing at the local level is it uses economies of scale to change how Capital flows into a local economy and how it stimulates the velocity of the productivity - Cloudfunding provides sellers with the potential to gain far greater scale at full selling prices, which in turn allows sellers to build great businesses and afford to be able to pay good wages that then comes back into local economies through spending - buyers gain from the greater buying power with Price Demand, and ultimately control the flow of business activity through the business's level of customer service, which as a result, the demand sets the pricing value of the products and services across an economy, all tracked on a Global Price Index.

What's often forgotten when the so called market dynamics push sellers to discounting products and services is the amount of local taxes that get lost forever - Cloudfunding saves those lost revenues that usually just evaporate from a seller's bottom-line, and the local economy, and instead provides the dynamics to gain the taxes from full revenues at the full selling prices.

The Digital Cash Economy is ubiquitous across local economies

The fluency of the process from the seller listing the inventory to the payment by the buyer breaks the complicated processes inflicted by early adoption of credit and debit cards in online commerce - Cloudfunding brings free Online Cash Commerce into the mainstream by digitizing traditional cash payments, just the same type as traditional cash exchanges are without fees - no more costly cards or interest payments, just simple ubiquitous free payments from a mobile - but with high end level security and tracking, which has shown to be the Achilles Heel of the card providers process - now with free Cashless QwickP2P's peer to peer universal exchange it's so simple to exchange any size purchase seamlessly across borders and economies without delays or costs.

The paradigm shift comes in reversing how incumbents have been able to extract local capital flows from local economies by centralizing control of the money supply via credit and debt - Cloudfunding decentralizes that control by keeping capital flowing within local economies, and increases it with Direct Foreign Decentralized Capital from other local economies around the world - this is where the local Chamber of Economies comes to the fore as part of the Global Chamber of Economies where productivity trends can be tracked.

Contact

Privacy Policy

Terms of Service